Contents:

Yes, but in the United Kingdom you must have a professional account. CMC Markets is also a leader in the area of education, with a broad range of materials including articles, video, podcasts, and webinars. Covers market moving news such as earnings releases and the reaction to it. CMC Markets accepts clients from the majority of countries globally. Whether you have good knowledge and understanding of trading derivatives and the relevant risks, particularly margin trading.

How will the SVB fallout affect the markets? – CMC Markets

How will the SVB fallout affect the markets?.

Posted: Mon, 13 Mar 2023 07:00:00 GMT [source]

One-minute charts show how the price of an instrument moves during each one-minute period. Hourly charts show how price moves during each hourly period and so forth. You can also select the total time period you want to view on a chart.

forex.com

There is no minimum deposit required to open an account at CMC Markets. Yes, CMC Markets does offer VWAP (volume-weighted average price), to do so a “Price Depth Ladder” is used, which allows you to have a clear view of the underlying market volumes and liquidities. CMC Markets is chess sponsored but this only concerns Australian clients as stockbroking is not currently available to UK based clients.

MetaTrader is a powerful platform with impressive features but the interface appears dated in comparison with the Next Generation Platform. What distinguishes MetaTrader is its ability to perform strategy backtesting and automated trading. This feature allows traders to open or close a trade with a single click, without having to confirm the order. There is a monthly fee of 10 units of your local currency after 12 months of inactivity. This fee is fairly standard for the industry and there are no deductions made if there are no funds in the account. In our research, CMC Markets showed a good level of transparency in areas such as their regulatory status, fees and general background information.

BP lifts the FTSE 100, as markets await Powell comments – CMC Markets

BP lifts the FTSE 100, as markets await Powell comments.

Posted: Tue, 07 Feb 2023 08:00:00 GMT [source]

Our award-winning mobile trading app allows you to seamlessly open and close trades, track your positions, set-up notifications and analyse mobile optimised charts. Get exposure to over 330 currency pairs on the world’s most liquid market. Trade on favourites like GBP, USD and EUR through to less popular currencies like the Turkish lira and Norwegian krone with spreads from as low as 0.7 pips. Having a long track record, being listed on a stock exchange and being regulated by top-tier authorities are all great signs for CMC Markets’s safety.

cmc forex broker traded funds are financial instruments that track an index or sector and trade like a stock on an exchange. An index is a basket of trading instruments that is used to gauge a market sector, stocks within an exchange or the economy of a country. In this section, we check the broker’s market offering and how varied the instruments and asset classes are. It will allow you to check if they offer what you’re looking for and what you can trade. This feature allows traders to execute orders with a single click and no secondary confirmation. Being able to place a trade with a single click saves time and is especially useful for short term traders.

If there is one criticism, it would have to be regarding the lack of a dedicated search function or well-organized archive, which makes it difficult to find many topics. Unlike some of their competitors’ platforms, Next Generation does not have a built-in tool for analyzing trading activity. Given all the features that have been included on this platform, maybe it’s asking for too much to include this as well, but this omission dropped them into the lower-ranking tier for this category.

Here, we focus on how long the broker has been in business, the size of the company and how transparent they are in terms of information being readily available. CMC Markets NZ Ltd. is authorised and regulated by the New Zealand Financial Markets Authority , reference number FSP41187. Ltd. is authorised and regulated by the Monetary Authority of Singapore . CMC Markets Canada Inc. is authorised and regulated by the Investment Industry Regulatory Organization of Canada . CMC Markets is regulated by multiple financial authorities around the world. Select one or more of these brokers to compare against CMC Markets.

Web trading platform

For forex and CFDs traders, copy trading and MetaTrader are both popular platform options. Both CMC Markets and FOREX.com offer MetaTrader 4 .Copy trading is not offered by either broker. In our analysis of 23 international regulators across 62 of the best forex brokers, CMC Markets is considered low-risk, with an overall Trust Score of 99 out of 99. FOREX.com is considered low-risk, with an overall Trust Score of 99 out of 99. Yes, CMC Markets is considered a safe forex broker by all industry standards. CMC Markets is regulated across 4 continents and has over 30 years of experience in the forex space.

Clients can fund their CMC Markets account via debit or credit cards or a bank transfer. There is no minimum deposit required to activate an account although you cannot trade without sufficient funds. Both deposits and withdrawals are simple to make via the “Payments” section of your account. Clients can withdraw funds to the same card used to make a deposit, provided they have used the card on their account within the last 12 months, and it is a Visa card.

Is CMC Markets a good broker?

In 1989, CMC Group was founded by Peter Cruddas in the UK as “Currency Management Corporation”—a Foreign Exchange market maker. In 1996, the company offered one of the earliest real-time forex trading platforms on the internet. CMC Group also began offering Contracts for Difference in 2000 and online spread betting in 2001. CMC largely defined how these products have been delivered to the retail market by offering them on the internet. CFDs and online spread betting are the core of CMC Group’s business today.

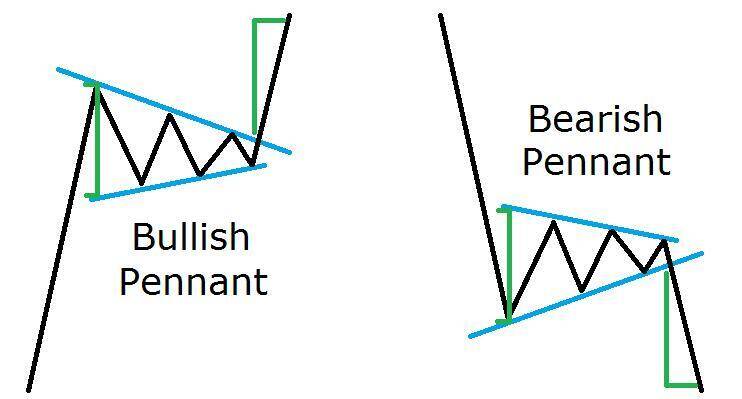

ForexBrokers.com also recognized brokers that demonstrated excellence and innovation with our exclusive Industry Awards. Furthermore, depending on the CMC Markets entity that holds your account, you may be eligible to receive compensation in the extraordinary event of the broker’s insolvency . We automatically scan over 120 of our most popular instruments every 15 minutes for emerging and completed chart patterns, such as wedges, channels and head & shoulders formations. Get the trade you want – we don’t reject or partially fill trades based on size.

The company went public in 2007, listing on the Warsaw Stock Exchange under the ticker symbol XTB, and it was rebranded as XTB Online Trading in 2009. Furthermore, the other weaknesses of average security and lack of platform diversity can be concerning to potential clients, detracting slightly from the CMC Markets experience. Traders who chose to spread bet have a choice of indices, forex, cryptocurrencies, commodities, treasuries & shares. Another nice feature of CMC Markets offer is trailing stop-loss. A trailing stop-loss ensures stop gaps are moved when a currency pairing moves in the predicted direction leading to profits. When the currency then moves the other way by a certain amount of points, the stop-loss will come into force at a more favourable price.

CMC Markets vs FOREX.com 2023

The main thing difference to be aware of between these two accounts is the use of leverage and the application of guaranteed negative balance protection. Using high forex leverage levels or margin allows traders to maximise their returns with a low capital investment when they take their position. Swissquote has a USD$1000 minimum deposit requirement while other brokers like Price Markets, Vantage have significantly high deposit requirements too. While a minimum deposit of $200 is an industry standard, CMC Markets have $0 minimum deposit requirements. Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site. CMC Markets offers their proprietary web platform, mobile app and MetaTrader 4.

This would be a red flag were it not for the fact that the company is regulated by the FCA which, along with U.S. regulatory agencies , is widely considered to be the preeminent regulatory body. The following table summarizes the different investment products available to CMC Markets clients. Launched in 2021, CMC Markets’ Dynamic Trading product for professional clients allows for the fine tuning of allocations through percentage weightings of investment portfolios. CMC Markets’ Next Generation platform features a massive selection of over 12,000 tradeable instruments.

CFD trading This popular form of leveraged trading allows you to go long or short on thousands of global markets, and hedge a physical portfolio. A glance at actual costs and whether CMC Markets is really free. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. At certain times, CMC Markets also organizes live webinars and regional seminars. Phone support is great, too; wait times were short, and all operators were helpful, speaking in a clear, understandable voice. When you type the name of the product, it will list all related assets, along with current bid/ask prices.

Particularly useful to day traders, who often look for opportunities in markets experiencing unusual short term volatility. This feature allows traders to be updated when an instrument reaches a specific price level. Alerts can be delivered via audio, an email, or a push notification to a mobile device. The Next Generation platform offers built in chart pattern recognition tools. The idea is that you can scan multiple instruments and timeframes for classic chart patterns that may have predictive value.

The global foreign exchange market is the largest and most actively traded financial market in the world. CMC provides traders access to an extensive range of offerings, both CFDs and spread betting, across several different asset classes. Additionally, the broker offers competitive spreads that are dynamic in that they widen or contract with trade sizes, and clients’ accounts are protected from going into a negative balance condition. It offers a broad variety of brokerage services geared towards sophisticated active traders, investors, professionals, and institutions. Smaller account holders may be disappointed by higher account minimums, a variety of fees, and fewer customer support options.

Because the entire process is electronic and automated, CMC Group is able to cut delays and decrease overhead. Before you begin using a forex broker, you should get as much information about the company as possible. You want to be confident that the company you chose fits your needs and will offer exactly the kind of service that suits you. CMC Group is one of the most significant forex brokers in the UK, and they are worthy of some close consideration. On the plus side, it has low forex fees, well-developed trading platforms, and terrific research and educational tools. CMC Markets has low forex and stock index CFD fees, but high stock CFD fees.

Customer Service

Like most CFD brokers, they do not accept clients from the United States or from FATF blacklisted countries North Korea and Iran. Your financial background information, such as the source of your trading funds, annual income and the amount of your savings and investments. These ranged from the basic, for example, ‘are funds segregated? ’ to more unusual inquiries such as ‘does CMC Markets offer VWAP? Overall we received a good quality of response in a timely fashion. A stock is a security that represents partial ownership of a corporation.

To conclude, the MetaTrader 4 desktop platform is one of the most feature-rich and popular trading platforms in the world. It does not have the best design and it does require some time and effort to learn, but that is typical of advanced platforms. A client sentiment tool lets you know what other clients within the platform are trading and whether they are long or short . Sentiment can be viewed across the whole client base or just among the top performing traders. Being able to work with different time frames allows traders to perform analysis specific to a given period.

- Still, this is an unavoidable danger of providing cutting-edge, sophisticated financial products while also making trading available to the retail market.

- These tools allow you to accomplish a lot, like draw resistance and support levels, highlight patterns and key price movements, and make notes right on the charts.

- Tiered accounts offer lower trading costs and added benefits as equity grows, but the majority of retail traders will have a tough time reaching the higher customer tiers.

- Given all the features that have been included on this platform, maybe it’s asking for too much to include this as well, but this omission dropped them into the lower-ranking tier for this category.

- In addition to the platform user guide and platform-specific FAQ, there are many other categories in the FAQ, including products, trading issues, price adjustments, and other user guides.

CMC Markets’ MetaTrader 4 offering has fewer tradeable symbols, but the addition of Beeks VPS as well as plugins from Autochartist and FX Blue in 2021 have greatly improved its offering. Competitive pricing is available for active traders – though the availability of discounts and rebate programs will depend on your country of residence . CMC Markets’ proprietary Next Generation trading platform is packed with quality research and innovative trading tools, and CMC Markets finished Best in Class across 11 categories for 2023. To help you understand how forex trading works, view our CFD examples, which takes you through both buying and selling scenarios. We combine 8 feeds from tier-one banks, to get you our most accurate price.

At BrokerChooser, we consider clarity and transparency as core values. BrokerChooser is free to use for everyone, but earns a commission from some of its partners with no additional cost to you . Stock CFD fees are high, and the product selection covers only CFDs , meaning no real stocks or ETFs available . Also, CMC Markets regularly discloses reports on the quality of trade executions , which is a really transparent practice and not very common at other brokers. CMC Markets is regulated by several financial authorities globally, including the UK’s top-tier FCA. It is listed on the London Stock Exchange, which means additional transparency.

A bank transfer can take several business days, while payment with a credit/debit card or PayPal is instant. Broker Reviews 24Option Broker review 2023 – A Detailed Product Guide with Regulations 24Option was created in 2008 and worked with binary options in the beginning. It is now a leading CFD and FOREX platform owned by Rodeler Ltd.

We check the https://traderoom.info/ content provided by the broker, its quality and suitability for beginners and advanced traders. One of the reasons that traders are attracted to the forex and CFD markets is the high degree of available leverage. Leverage is the use of borrowed funds to increase the size of your trading positions beyond what would be possible using only the cash in your account.