If the vent flow is displayed as loss of $100 per hour based on the flow and value of steam, it is easier to communicate to operators the importance of eliminating that method of operation. To find your overhead cost, add up all your subtotals of expenses, direct and indirect. Divide your total expenses for the plant by the total number of units you produce.

Cactus Plants: How to Grow and Care For These Prickly Greens – Real Simple

Cactus Plants: How to Grow and Care For These Prickly Greens.

Posted: Tue, 05 Sep 2023 21:46:31 GMT [source]

This annual industry-leading event addresses the production challenges you face every day. You can depend on our thought-provoking keynotes, insightful tech sessions, and hands-on labs to help you learn about the latest process automation technologies. The newest release of PlantPAx offers more valuable technical features than ever before. These demo videos will walk operators and engineers through specific features of the latest version of the modern DCS. Explore how to improve productivity,

drive profitability and help reduce risks with PlantPAx®. Download our Digital Transformation Roadmap and learn what steps you can take to achieve data-driven success in manufacturing.

An efficient method for on-line identification of steady state

The tiny forest lives atop an old landfill in the city of Cambridge, Mass. Though it is still a baby, it’s already acting quite a bit older than its actual age, which is just shy of 2. Native plants crowded onto postage-stamp-size plots have been delivering environmental benefits around the world — and, increasingly, in the U.S. We offer industry expertise to help design, implement and support your automation investment. PlantPAx DCS leverages advancements in our design and configuration platforms. The PlantPAx System Estimator (PSE) allows you to quickly build and validate your architecture based on your requirements.

If a steady-state period is erroneously detected and one tries to adapt the model parameters using transient information, the set of parameters will not be able to capture the relations represented by the steady-state model. As a consequence, it will affect the model accuracy and the closeness of the RTO solution to the true optimum (Engell, 2007). A poor estimate can cause plant-model mismatch even if the model is a perfect representation of the plant.

Words Near Plantwide in the Dictionary

Plantwide, Inc. specializes in filtration and drying technologies for compressed air and gas applications as well as nitrogen gas generators. For more than 20 years, Plantwide, Inc. has served a wide range of industries including manufacturing, food and dairy, analytical instruments, optical, metal fabrication, power generation and more. By choosing our high quality filtration and gas separation solutions our customers experience higher profitability and increased productivity. These problems become even more acute if the size of the process increases. When dealing with a process composed by several units, if there is a single unit that is constantly affected by disturbances, for example, the complete system cannot be considered at steady-state. Instinctively, the larger the system the smaller the probability of the process to be at steady-state.

The collection does not reflect topic-specific statements that have been expressed by EPA though published rule preambles and Title V petition orders, nor does it include EAB decisions. Each document in the collection speaks for itself, and the inclusion or exclusion of a document in the collection is not intended by EPA to communicate anything more than what is expressed within each document. EPA makes no independent representations on this website as to the extent to which any document in the collection reflects EPA’s current views on the topic, is a final action by EPA, or has any legal effect or precedential weight. Readers are advised to review the documents in the collection and conduct their own assessment of such considerations based on the content of each document and other documents in the collection.

Plant-wide control of the Tennessee eastman problem

Because a Miyawaki forest requires intense site and soil preparation, and exact sourcing of many native plants, it can be expensive. The Danehy Park forest cost $18,000 for the plants and soil amendments, Mr. Putnam said, while the pocket forest company, SUGi, covered the forest https://online-accounting.net/ creators’ consulting fees of roughly $9,500. In recent years, they’ve been planted alongside a corrections facility on the Yakama reservation in Washington, in Los Angeles’s Griffith Park and in Cambridge, where the forest is one of the first of its kind in the Northeast.

The applicability of these alternatives is discussed by means of case studies of increasing complexity, for which detailed design, control and dynamic simulation results are provided. The non-linear behaviour of Reactor–Separation–Recycle systems is also discussed. The subject gives the opportunity of reviewing basic concepts of process control.

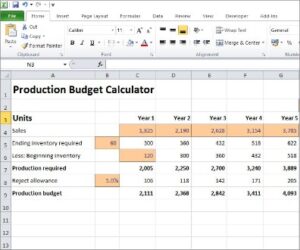

How to Calculate Plant-Wide Overhead Rate

This paper focus on one of them, which is how to determine the optimization scope. However, the optimal solution of an individual unit can diverge significantly from the whole plant optimal solution (Bailey et al., 1993). Since the plant economics are determined by the overall plant behavior, the optimization needs to take into account a plant-wide perspective (Skogestad, 2000).

- He wanted to protect old-growth forests and encourage the planting of native species, arguing that they provided vital resilience amid climate change, while also reconnecting people with nature.

- FactoryTalk® Batch provides efficient, consistent predictable batch processing that supports the reuse of code, recipes, phases, and logic.

- Modern manufacturing philosophy says that minimizing inventory is one way to reduce costs.

- FactoryTalk Batch combines the ISA-88 standard with proven technology that provides the flexibility ranging from enterprise-wide architectures to complex single-unit applications.

- Instead of figuring overhead costs for each product, you can calculate plant-wide expenses.

- A key topic is the control of species inventory, which can be achieved either by feedback or by relying on self-regulation.

He wanted to protect old-growth forests and encourage the planting of native species, arguing that they provided vital resilience amid climate change, while also reconnecting people with nature. Our batch control solutions provide a flexible control environment to help you meet your demands for increased production and improved yields. From the plant floor to the top floor, organizations need a global partnership that understands their industry to achieve a lifecycle strategy. Rockwell Automation delivers ingenuity by combining domain expertise and technology. We partner at every stage of your lifecycle to expand what is possible for your business so you can expand what is possible for your customers. PlantPAx, the modern DCS, provides a single, plant-wide control system and increased flexibility to enable better business decisions.

Just as importantly, it should present, in various formats, the same conditioned and calculated values to everyone throughout the mill. By using a single set of values, all the decision makers from the planners and engineers to the process operators are all working with the same up-to-date data. Modern manufacturing philosophy says that minimizing inventory is one way to reduce costs.

This paper proposes a variant of ROPA, named asynchronous ROPA (asROPA), where the plant-wide model is partitioned into submodels and, depending on their characteristics, their parameters are updated using either online or steady-state estimators. Consequently, it is not necessary to obtain a dynamic model for the whole process. This asynchronous updating strategy allows the plant-wide model to be up-to-date to the process and the plant-wide optimization can be scheduled at any arbitrary time. The new strategy is applied to a case study consisting of a system whose model can be partitioned into a separation and a reaction submodel. The plant-wide results indicate that asROPA reacts much faster to the disturbances in comparison to the TS approach, improving the overall economic performance and is able to drive the system to the plant-wide optimum.

In the Netherlands, Daan Bleichrodt, an environmental educator, plants tiny forests to bring nature closer to urban dwellers, especially city children. In 2015, he spearheaded the country’s first Miyawaki forest, in a community north of Amsterdam, and has overseen the planting of nearly 200 forests since. Industrial automation services to support your manufacturing plant or facility throughout its lifecycle, whether you need to design, build, sustain or improve. It is the role of a plant-wide information system to make this interchange of data happen. A steam vent of 10,000 lbs per hour may provide a convenient way to operate a given process for a period of time, but it comes at a cost.

Sludge and water lines were both included in to assess the effect of any change in the operating conditions on all components of the plant including sludge units. FactoryTalk® Batch provides efficient, consistent predictable batch processing that supports the reuse of code, recipes, phases, and logic. FactoryTalk Batch combines the ISA-88 standard with proven technology that provides the flexibility what is the 3-day rule when trading stocks ranging from enterprise-wide architectures to complex single-unit applications. It also allows you to apply one control and information system across your process to improve capacity and product quality, save energy and raw materials, and reduce process variations and human intervention. On the other hand, there are still some open issues in the literature that have not been widely addressed.

This reduces the lifecycle cost of the system and lowers operational risks in operations. The basic idea is to divide the plant model f into submodels fi, then group them in partitions (either steady-state or dynamic estimation clusters), and use the corresponding estimation strategy to update the submodel parameters of each partition. Next, the plant-wide model f with the updated parameters can be used for economic optimization. Then, the issues of plant-wide optimization are further discussed and our method is presented in Section 3. In this section we also suggest a strategy for partitioning the plant-wide model. Section 4 details the case study characteristics, explains the optimization problem and shows how the asynchronous model updating strategy is configured.